Credit limit

Encouraged timely payments through credit limit design in B2B e-commerce.

Duration

Nov 2025 - Dec 2025

Team

1 UIUX Designer

2 Engineers

1 Product Owner

My role

Planned the feature end-to-end, including scope, requirements, information architecture, and website placement.

Developed design strategies.

Designed UI mockups.

Background

Credit limit as a mechanism to mitigate continuously deferred payments.

In a B2B trading context, customers pay after receiving goods, delaying revenue recognition and creating cash flow challenges. To mitigate this risk, we have implemented a credit limit mechanism that our sales and finance teams actively monitor. When a customer reaches their credit limit, we suspend new orders until they make payments to restore available credit.

Objective

Create a new feature to inform customer credit limits and encourage timely payments.

Our e-commerce platform currently lacks visibility into credit limits, leaving customers unaware of their payment status. This new feature will provide real-time credit limit information directly on the platform.

Design strategies

Developed design strategies to ensure consistent decision-making and alignment with the objective.

Design highlights

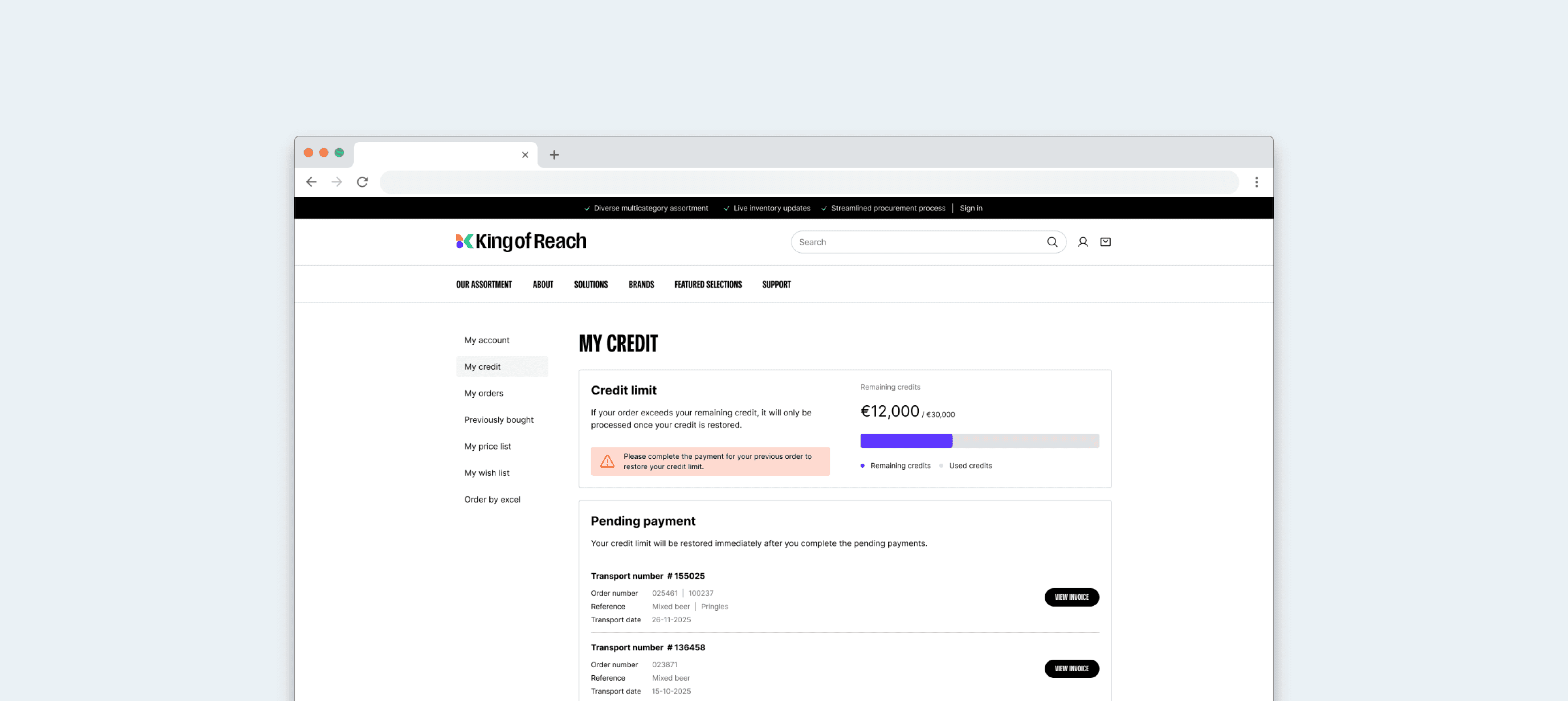

Designed a dashboard that visualizes key data, giving users a clear overview of remaining credit, limits, and unpaid invoices.

Created a dedicated My Credit section to consolidate payment information.

Initially, I placed the credit limit chart in My Account and centralized invoices within existing order pages to avoid information scatter. After learning that invoices were buried in Transport Detail subpages due to consolidated shipments and shipping fees, I created a dedicated My Credit section to bring together credit limits and unpaid invoices for better visibility and easier access.

Reframed credit limits from highlighting the used credit to the remaining credit.

Credit limits are commonly seen in credit cards and digital banking applications. Most credit limit features related to credit cards focus on displaying used credit, as these features primarily support spending control. However, in B2B e-commerce, credit limits are designed to enable order completion rather than restrict spending. Therefore, I decided to highlight the remaining credit instead of the used credit.

Visualized the remaining credits to improve user awareness.

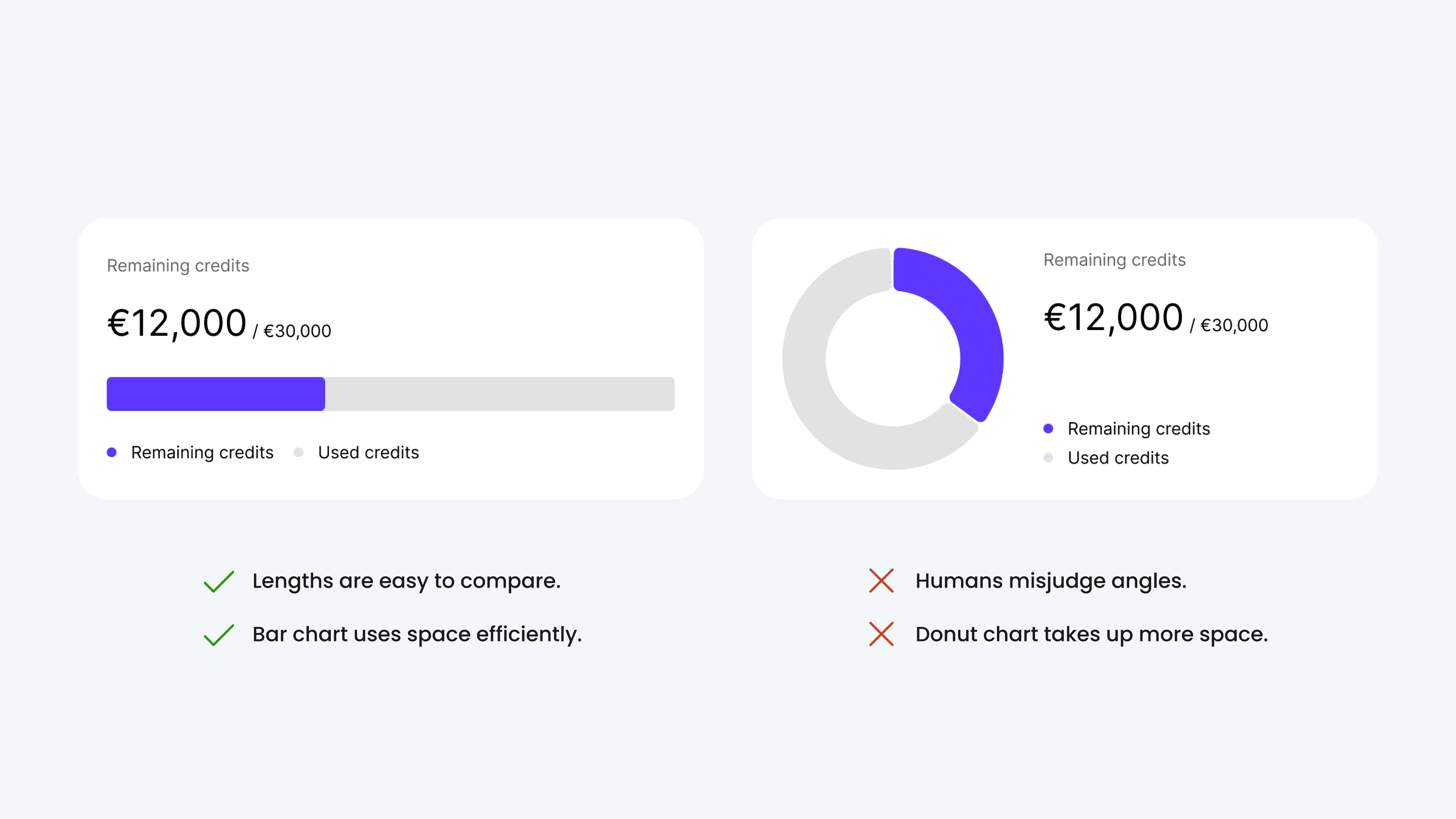

To enhance transparency, I designed visualizations comparing bar and donut charts. I selected the bar chart for its superior readability. Users can instantly grasp their remaining credit at a glance. When credit drops below 20%, the bar turns red to signal urgency and prompt payment.

Designed alert banners across key touchpoints to communicate credit status and restoration steps.

I created the alert banner to inform customers about their current credit limit, potential consequences, and guidance on restoring credit, displaying this component at different touchpoints such as the shopping cart and the Order by Excel page.

Designed positive reinforcement to acknowledge timely payment behavior.

Since payment is inherently the customer’s responsibility, we cannot offer tangible rewards or incentives for early or on-time payments. Therefore, I focused on using a positive clap icon and text to acknowledge and reinforce customers’ payment behavior.

Result

The new feature lays a foundation for timely payments by giving customers direct visibility into their credit status and due actions.

The feature also helps reduce the workload of the sales and finance teams, as customers can now access clearer information and check their remaining credit on their own.

Lessons learned

Design creates value by aligning user needs with business goals.

Through this project, I learned how interface design can create real value by meeting user needs, such as clarifying what information they require and what actions they need to take, while also supporting the business strategy of driving revenue recognition. I also gained deeper insight into the B2B buying journey, how it differs from B2C behavior, and how the trading industry operates.